From http://www.safehaven.com/article-13063.htm

PDF version here.

1

A

CRITIQUE OF THE QUANTITY THEORY OF

MONEY

Further

evidences of the onset of Great Depression II

Antal

E. Fekete

Professor

of Money and Banking

San

Francisco School of Economics

aefekete@hotmail.com

In

my previous paper The

Revisionist Theory and History of Depressions I

argued

that persistently falling interest rates cause an erosion of capital,

unseen

but

nonetheless lethal. Producers are squeezed and try to survive by

cutting

prices.

Lower prices add to pressures lowering interest rates, and a vicious

spiral

is set in motion. Thus money-creation by the Fed has a little-noticed

deflationary

side-effect to it, that may ultimately overwhelm the inflationary

effect,

in spite of predictions by the Quantity Theory of Money.

Money

out of the thin air?

Detractors

of our fiat money system (myself not

included) are fond of

saying

that

“the Fed is creating money out of the thin air.” If that

were true, then the

Quantity

Theory of Money (QTM) might be valid implying that the present

runaway

money-printing exercise would indeed lead to hyperinflation before

long.

How could anyone suggest that the denouement will be deflationary

after

all?

I

maintain that the

Federal Reserve banks are not

creating

money out of

the

thin air. In fact,

they

must first post collateral with

the Federal

Reserve

Agent

(who is not under the jurisdiction of the Fed but under that of the

government). Only after the

collateral has been posted can they

create

a commensurate amount of

Federal

Reserve notes and deposits. Typically, the

collateral

is U.S. Treasury bills, notes, or bonds, purchased in the open market

on

behalf of the Fed’s Open Market Committee.

2

Because

open market purchases of Treasury paper have consequences, we

must

examine them before passing a judgment on the validity of the QTM.

Such

an

examination is always side-stepped by the devotees of the QTM. What

are

those

consequences? They are the effect of open market operations on the

rate of

interest.

Since open market purchases of the Fed involve bidding up the price

of

government

obligations which varies inversely with the rate of interest, we can

say

that they will make interest rates fall. (To be sure, on occasion,

the Fed may

be

a seller of Treasury paper but, on a net basis, it has been a buyer

every single

year.)

This

means that the regime of irredeemable currency,

depending as it is on

the

open market operations of the Fed for its existence, imparts a

definite bias to

the

interest rate structure establishing a falling

trend, whereas

interest rates

would

be stable in the absence of that regime. This in itself is a

condemnation of

irredeemable

currencies as they introduce an unwarranted

bias into the economy

favoring

debtors and spenders while punishing creditors and savers. In

addition,

it

favors the financial sector at the expense of

the producing sector. Falling

interest

rates, as opposed to low but stable ones, are detrimental

to productive

capital.

Thus

we have two effects to reconcile as a

consequence of money creation

by

the Fed: an inflationary and a deflationary

one. We cannot say which

of

these two forces will ultimately prevail without digging deeper.

That

is to say (I think):

|

Fed's

OMO long-term Treasuries buying (net) + Fed's toxic asset buying

-> increased M1, M2, M3 -> inflationary

(per Friedmanites).

|

|

Fed's

OMO net long-term Treasuries buying holds long-term interest rates

down -> declining interest rates -> erosion of capital ->

producers squeezed, cut prices -> deflationary

side-effect (per Fekete)

|

|

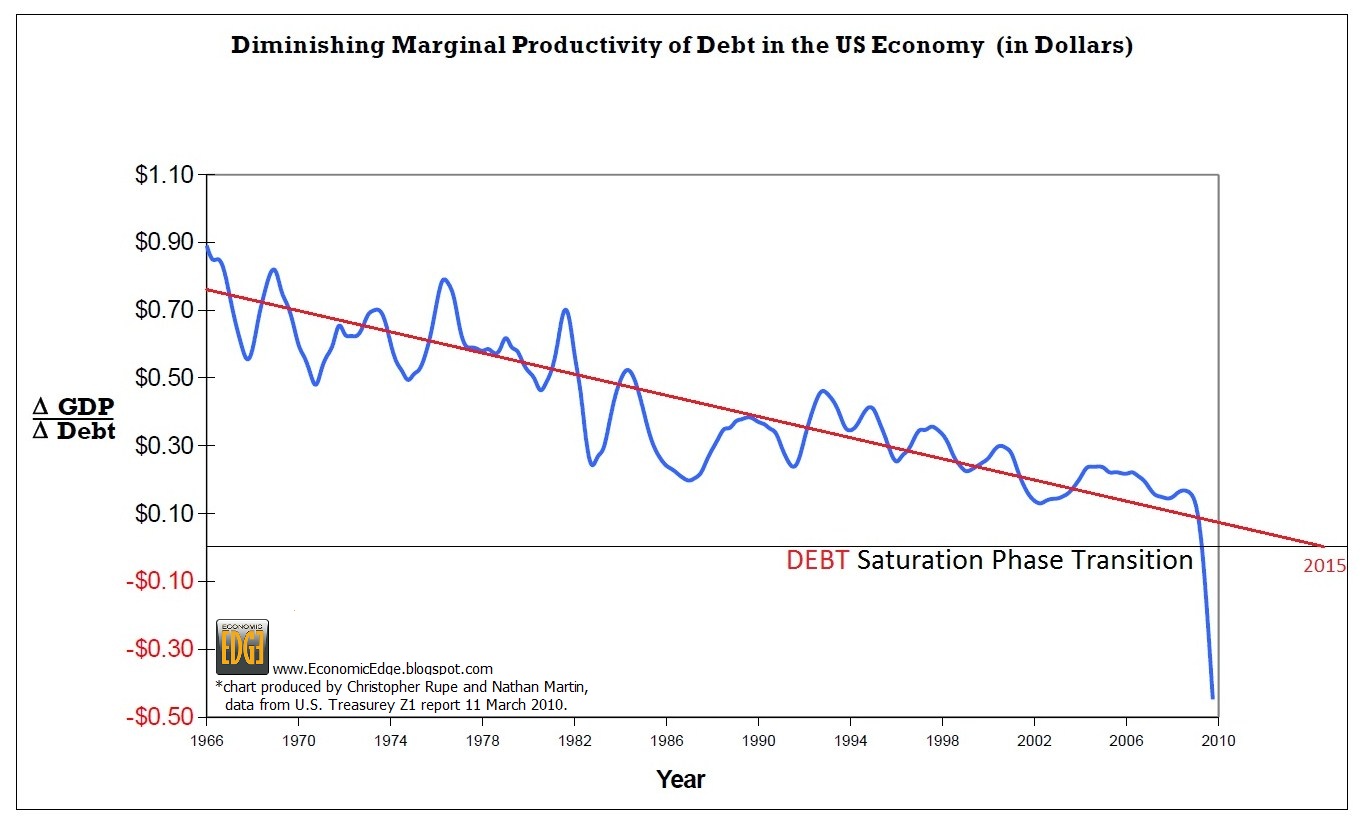

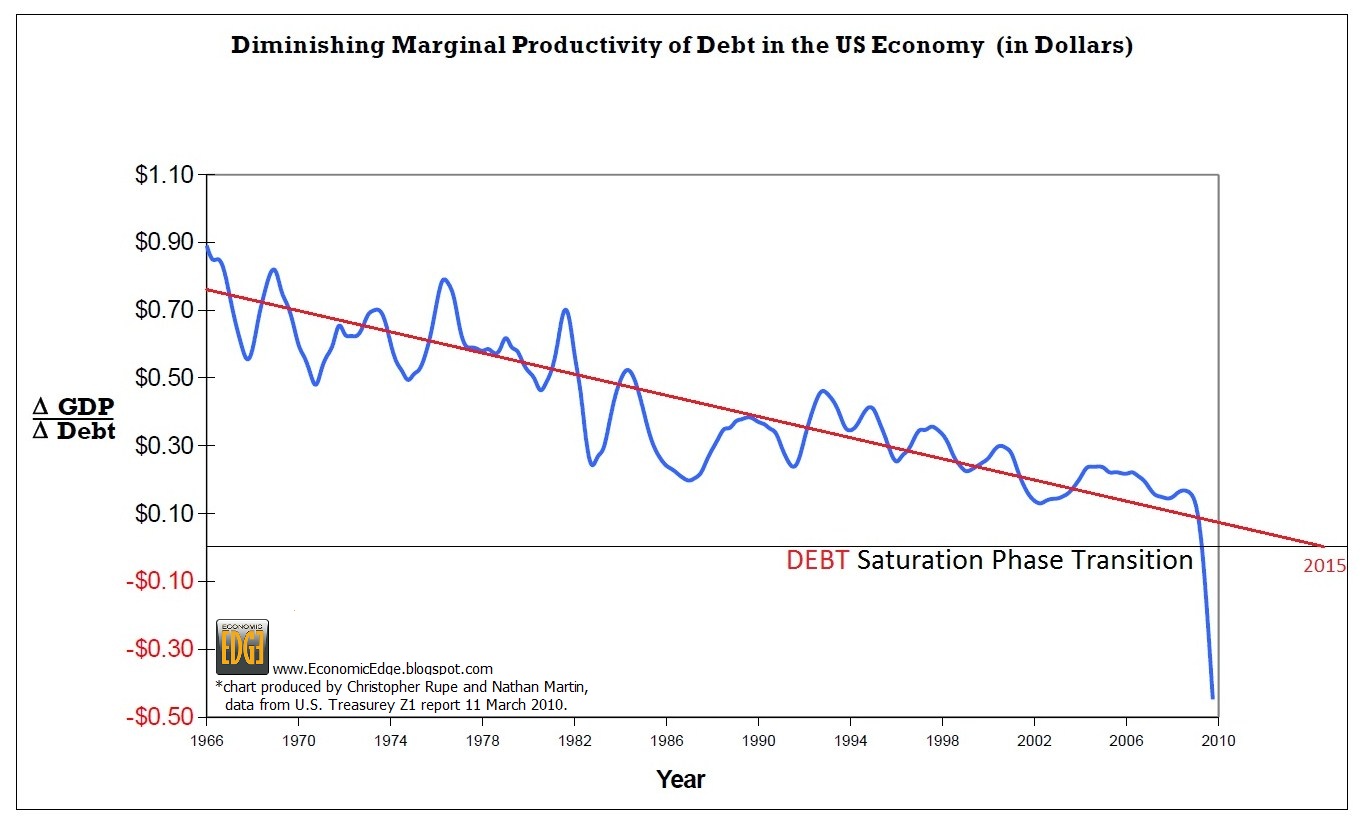

This

chart of the Diminishing Marginal Productivity of Debt in the US

Economy offers numbers somewhat inconsistent with Fekete's

discussion below for, e.g., the year 2006.

|

Risk

free bond speculation

In

the actual case there are other important forces at play, which are

induced by

the

Fed’s open market purchases. We have to take into account bond

speculation,

a permanent fixture on the monetary firmament since 1971 when

the

U.S. government defaulted on its gold obligations to foreign

governments

and

central banks. (There

was no

bond

speculation before,

for reasons having to

do

with the lack of sufficient variation in the rate of interest, making

such

speculation

unprofitable.) Analysts and financial writers hardly ever consider

bond

speculation as a factor in the money-creating process. For this

reason

alone,

their predictions are practically always worthless.

The

fact goes virtually unrecognized that open

market operations render

bond

speculation risk free.

All the speculators have to do is to second-guess the

Fed.

They know that the Fed must be a net buyer. They

know the identity of the

agents

the Fed is using to execute its purchase orders, and

stalk them.

Speculators

study the same monetary statistics which the Fed itself is using to

determine

the timing of its open market purchases. Can the Fed outsmart

speculators?

Hardly. The Fed is run by bureaucrats and their trading losses are

‘on

the house’. By contrast, the speculators risk their own

fortune. They are

certainly

smart enough to detect false-carding on the part of the Fed. Even if

we

assume

that they have no inside information (which is a rather naïve

3

assumption),

the speculators can easily front-run the Fed’s open market

purchases.

The

presence of risk-free bullish bond speculation imparts a huge

additional

bias to the economy, virtually guaranteeing a

falling interest-rate

structure,

as demonstrated by the past quarter of a

century, during which interest

rates

have been driven down from the high teens to close to zero. It may

distort

the

ultimate outcome of this latest tragic experimentation with

irredeemable

currency.

No longer can it be taken for granted that

the denouement of unlimited

money-creation

will be hyperinflation with the Federal Reserve notes rapidly

losing

purchasing power. On the contrary, it could be an unprecedented

deflation

with the Federal Reserve notes being hoarded by the people, firms,

and

institutions

as their purchasing power is actually increasing (in fact, they are

already

being hoarded by foreigners in the second and third world countries

in

unprecedented

amounts). The dollar will not be the

first among irredeemable

currencies

to be annihilated in this latest hecatomb of currencies. It will

be last

one.

Price

wars

The

QTM is a linear model that may be valid as a first approximation, but

fails in

most

cases as the real world is highly non-linear. My own theory predicts

that it is

not

hyperinflation but a vicious deflation

which is in store for the dollar. Here is

the

argument.

While

prices of primary products such as crude oil and foodstuffs may

initially

rise, there is no purchasing power in the hands of the consumers, nor

can

they

borrow as they used to do in order to pay the higher prices much as

though

they

would like to do, to support it. The newly created money is going

into bailing

out

banks, much of it being diverted to continue paying bloated bonuses

to

bankers.

Very little, if any of it has “trickled down” to the

ordinary consumer who

is

squeezed relentlessly on his debts contracted when interest rates

were higher.

It

turns out that the price rises are unsustainable as the consumer is

unable to

pay

them. They will have to be rescinded. Retail merchants will start a

damaging

price

war underbidding one another. Wholesale merchants are also squeezed.

They

have to retrench. Pressure from vanishing demand is further passed on

to the

producers

who have to retrench as well. All of them experience ebbing cash

flows.

They lay off more people. This aggravates the crisis further as cash

in the

hand

of the consumers diminishes even more through increased unemployment.

The

vicious spiral is on.

But

what is happening to the unprecedented tide of

new money flooding the

economy?

Well, it is used to pay off debt by people desperately scrambling to

get

out

of debt. Businessmen are lethargic; every cut in the rate of interest

hits them

by

eroding the value of their previous investments. In my other writings

I

have

explained

how falling interest rates make the liquidation value of debt rise,

which

4

becomes

a negative item in the profit-and-loss statement eating into capital

of

businesses.

Capital ought to be replenished but isn’t.

Worse

still, there is no way businessmen can be induced to make new

investments

as long as further reductions in the rate of interest are in the

cards.

They

are aware that their investments would go up in

smoke as the rate of interest

fell

further in the wake of “quantitative easing”.

Self-fulfilling

speculation on falling interest rates

The

only enterprise prospering in this deflationary environment is bond

speculation.

Speculators corner every dollar made available by the Fed, and use it

to

expand their activities further in bidding up bond prices. They have

been told in

advance

that the Fed is going to move its operations from the short to the

long end

of

the yield curve. It will buy $300 billion worth of longer dated

Treasury issues

during

the next six months. It is likely that it will have to buy much more

after

that.

Speculation on falling interest rates becomes self-fulfilling, thanks

to the

insane

idea of open market operations making, as it does, bullish bond

speculation

risk-free

and bearish bond speculation suicidal.

Deflation is made self-sustaining.

Investors

are urged by the Treasury and the Fed to invest in the toxic assets

of

the failing banking system. They are offered incentives if they do,

making it

appear

that speculating in toxic assets has been made risk free as well. So

the

choice

before the investors is either investing in toxic assets for which

there is no

market,

or invest in Treasury paper which bond speculators and foreigners are

scrambling

to get. Naturally, they will choose the latter. They don’t want

to be

taken

for a ride by the Treasury and the Fed. The idea to offer incentives

to

investors

to make them buy toxic assets is preposterous.

Marginal

productivity of debt

Another

way to understand the problem is through the marginal

productivity of

debt.

This is the ratio of additional

GDP to additional debt,

or the amount of

new

GDP contributed by the creation of $1 in new debt. It is this ratio

that

determines

the quality of total

debt. Indeed, the

higher the ratio, the more

successful

entrepreneurs are in increasing productivity, which is the only valid

justification

for going into debt in the first place. The concept is due to the

Hungarian-born

Chicago economist Melchior Palyi (1892-1970), although its

name

has been introduced after he died.

Palyi

started watching this ratio in the United States in 1945. Initially

it

was

3 or higher,

meaning that every dollar of new debt contracted contributed $3

to

GDP. However, subsequently the ratio went into a decline and twenty

years

later

it was around 1.

Palyi ran a weekly column in The

Commercial and

Financial

Chronicle entitled A

Point of View. On

January 2, 1969, he publicly

warned

president-elect Nixon in his column that the country is adding $2 in

debt

5

for

every $1 increase in GDP (in other words, the marginal productivity

of debt

is

½).

“Does

Mr. Nixon realize the kind of ‘heritage’ he is taking

over? That

he

is supposed to keep up a rate of economic growth or even improve on

the

same, a rate that stands or falls with an utterly reckless mortgaging

of

the

future?... Presently, the volume of outstanding debt is rising faster

than

the gross national product… True, most of the new debt —

other

than

that of the federal government — has a ‘counterpart’

in real assets:

homes,

automobiles, plants and equipment, etc. But their value in dollars

is

unpredictable, while the debts are due in a fixed number of dollars…

“Trading

on the Equity was the earmark of the 1920’s. The ‘House

of

Credit

Cards’ broke down as the first cold wind — a serious

decline in

commodity

prices — hit the structure of artificially inflated values of

real

estate

and equities. The more debt had been piled up, the higher went the

stock

market. And so it goes today, only more so. A new generation of

operators

has arisen, one that has not witnessed as yet a wholesale debt

liquidation.

The

experience of the fathers is lost on the sons. The dream

of

Eternal Prosperity is replaced by the mirage of Perpetual Inflation.

More

is at stake than mere economics. A ‘new frontier’ has

captured the

imagination:

‘Young man, go in debt!’ Debt has become a status-symbol

—

in

addition to being a prime source of riches. Automobile sales hit

new

records because millions of Americans buy (on down payment) new

cars

before they have finished paying for the old ones… True, to

some

extent

rising living standards reflect extraordinary technological progress.

But

the ultimate base is, largely, the ability not

to pay — to

rely on the

ability

to borrow ever more.”

As

we know, in 1969 president Nixon did not listen to sound advice. As

president

Obama forty years later, he appointed dyed-in-the-wool Keynesian and

Friedmanite

advisers. The concept of marginal

productivity of debt is curiously

missing

from the vocabulary of mainstream economists. They

are watching the

wrong

ratio, that of the GDP to total debt, and take comfort in the

thought that

by

that indicator ‘there is lots more room’ to pile on more

debt. As a

consequence,

the marginal productivity of debt went into further decline. This

was

a danger sign showing that additional debt had no economic

justification.

The

volume of debt was rising faster than national income, and capital

supporting

production was eroding fast. If, as in the worst-case scenario, the

ratio

fell into negative territory, the message would be that the economy

was on

a

collision course with the iceberg of total debt and crash was

imminent. Not

only

does more debt add nothing to the GDP,

in fact, it necessarily causes

economic

contraction,

including greater

unemployment.

Immediate action is

absolutely

necessary to avoid collision that would make the ‘unsinkable’

economy

sink.

6

The

watershed year of 2006

As

long debt was constrained by the centripetal force of gold in the

system,

tenuous

though this constraint may have been, deterioration in the quality of

debt

was relatively slow. Quality caved in, and quantity took a flight to

the

stratosphere,

when the centripetal force was cut and gold, the only ultimate

extinguisher

of debt there is, was exiled from the monetary system. Still, it took

about

35 years before the capital of society was eroded and consumed

through a

steadily

deteriorating marginal productivity of debt.

The

year 2006 was the watershed. Late in that year the marginal

productivity of debt dropped

below

zero for the first time ever, switching on

the

red

alert sign to warn of an imminent economic catastrophe. Indeed, in

February,

2007, the risk of debt default as measured by the skyrocketing cost

of

CDS

(credit default swaps) exploded and, as the saying goes, the rest is

history.

Negative

marginal productivity

Why

is a negative marginal productivity of debt a sign of an imminent

economic

catastrophe?

Because it indicates that any further increase in indebtedness would

inevitably

cause further economic contraction. Capital is gone; production is no

longer

supported by the prerequisite quantity and quality of tools and

equipment.

The

economy is literally devouring itself through debt. The

earlier message, that

unbridled

breeding of debt through the serial cutting of the rate of interest

to zero

was

destroying society’s capital, has been ignored.

The budding financial crisis

was

explained away through ad

hoc reasoning, such

as blaming it on loose credit

standards,

subprime mortgages, and the like. Nothing was done to stop the real

cause

of the disaster, the fast-breeder of debt. On the contrary,

debt-breeding was

further

accelerated through bailouts and stimulus packages.

In

view of the fact that the marginal productivity of debt is now

negative, we

can

see that the damage-control measures of the Obama administration

which are

financed

through creating unprecedented amounts of new debt, are

counterproductive.

Nay,

they are the direct cause of further economic

contraction of an

already

prostrate economy, including unemployment.

The

head of the European Union and Czech prime minister Mirek Topolanek

has

publicly said that the plan to spend nearly $2 trillion to push the

U.S.

economy

out of recession is “road to hell”.

There is no reason to castigate Mr.

Topolanek

for his characterization of the Obama plan. True, it would have been

more

polite and diplomatic if he had couched his comments in words to the

effect

that

“the Obama plan was made in blissful

ignorance of the marginal productivity

of

debt which was now negative and falling further. In consequence more

spending

on stimulus packages would only stimulate deflation and economic

contraction.”

7

President

Obama, like president Nixon before him, missed an historic

opportunity

in not ordering a complete change of guards at the Treasury and at

the

Fed.

Now the same gentlemen who have landed the country and the world in

this

unprecedented

débâcle are in charge of the rescue effort. The QTM, the

corner

stone

of Milton Friedman’s monetarism, is the wrong prognosticating

tool. The

marginal

productivity of debt is superior as it focuses on deflation

rather than

inflation.

The

financial and economic collapse of the past two years must be seen as

part

of the progressive disintegration of Western civilization that

started with the

sabotaging

of the gold standard by governments exactly one hundred years ago

when

in France and in Germany paper money was made legal tender. The

measure

was introduced in preparation to the coming war, so that the

government

could

stop paying the military and the civil service

in gold coins, starting in 1909.

Fed

Chairman Ben Bernanke, who should have been

fired by the new

president

on the day after Inauguration for his part in causing the cataclysm,

a

couple

of years ago foolishly boasted that the government has given him a

tool,

the

printing press, with which he can fight off deflations and

depressions, now and

forever.

The reference to the GTM [QTM (Quantity Theory

of Money?] is obvious.

Now

Bernanke has the honor to administer the coup

de grâce to our

civilization.

April

15, 2009

Reference

The

Revisionist Theory and History of Depressions, see:

www.professorfekete.com

[See

also his earlier (March 28) THE

MARGINAL PRODUCTIVITY OF DEBT.html ]

Calendar

of Events

Instituto

Juan de Mariana: Madrid, Spain, June 12-14, 2009

Seminar

with Prof. Fekete on Money, Credit, and the Revisionist Theory of

Depressions

For

information, contact: gcalzada@juandemariana.org

OroY

Finanzas & Portal Oro: Madrid, Spain, June 18, 2009

Gold

and Silver Meeting Madrid 2009

For

information, contact: preukschat_alex@hotmail.com

or

gcalzada@juandemariana.org

or

http://www.portaloro.com/aemp.aspx

or

info@portaloro.com

8

San

Francisco School of Economics: A Series of three Investment Seminars:

July

25; August 1; and August 8, 2009

The

Gold and Silver Basis; Backwardation; Trading Gold in the Present

Environment;

Wealth

Management under the Regime of Irredeemable Currency. Given by

Professor

Fekete

and Mr. Sandeep Jaitly of Soditic Ltd., London, U.K. Enrolment is

limited, first come

first

served. For more information, see: www.sfschoolofeconomics.com

San

Francisco School of Economics: July 27-August 7, 2009

Money

and Banking, a 20-lecture course given by Professor Fekete.

Enrolment is

limited;

first come, first served. The Syllabus for this course can be seen on

the website:

www.professorfekete.com,

see also: www.sfschoolofeconomics.com

University

House, Australian National University, Canberra: first week of

November, 2009

Peace

and Progress through Prosperity: Gold Standard in the 21st

Century

This

is the first conference organized by the newly formed Gold Standard

Institute.

For

further information, e-mail: feketeaustralia@gmail.com

,

On

the Gold Standard Institute, e-mail

philipbarton@goldstandardinstitute.com

Professor

Fekete on DVD: Professionally produced DVD recording of the address

before the

Economic

Club of San Francisco on November 4, 2008, entitled The

Revisionist History of the

Great

Depression: Can It Happen Again? plus an interview with Professor

Fekete. It is

available

from www.Amazon.com and

from the Club www.economicclubsf.com at

$14.95

each.

[Follow-up below.]

The

Economic Statistic US Elites Keep ‘Hush-Hush’

Monday,

6 June 2011 at 12:40, By Ron Robins,

Founder & Analyst - Investing for the Soul

It

is a simple statistic that continues to warn of huge economic

problems ahead for the US. Some economists call it the ‘marginal

productivity of debt (MPD).’ It relates the

change in the level of all debt (consumer, corporate, government

etc.) in a country to the change in its gross domestic product (GDP).

However, due to the message it is delivering, most US economists

employed in financial institutions, governments and private industry,

as well as financiers and politicians, want to ignore it.

And

for the US economy and government finances, the MPD (and related

variants of it) is continuing to indicate extremely

difficult economic times ahead.

I

have vague recollections of the MPD concept from my economics classes

long ago. But I was re-introduced to it around 2001

by a renowned economist who, during the following few years prior to

his passing, became alarmed as to the MPD path of the US. His name

was Dr. Kurt Richebächer, formerly chief economist and managing

director of Germany’s Dresdner Bank. Dr. Richebächer, was

so respected that former US Federal Reserve Chairman, Paul Volcker

once said of him that, “sometimes I think that the job of

central bankers is to prove Kurt Richebächer wrong,"

reported the online financial journal, The Daily Reckoning on May 15,

2004.

Investigating

Dr. Richebächer’s concern further, I wrote an article on

my Enlightened Economics blog on January 23, 2008,

titled, Is the Amazing US Debt Productivity Decline Coming to a Bad

End? I found that, “for decades, each dollar of new debt has

created increasingly less and less national income and economic

activity. With this ‘debt productivity decline,’ new

evidence suggests we could be near the

end-game... ”

Another

way of viewing the debt productivity problem is to look at it in

terms of how many dollars of debt it took to help create total

national income, which is the wages, salaries, profits, rents and

interest income of everyone. Again, from my above mentioned article,

which quotes Michael Hodges in his Total America Debt Report, that,

“in 1957 there was $1.86 in debt for each dollar of net

national income, but [by] 2006 there was $4.60 of debt for each

dollar of national income - up 147 per cent. It also means this extra

$2.74 of debt per dollar of national income produced zilch extra

national income. In 2006 alone it took $6.32 of new debt to produce

one dollar of national income.”

Such

data helps explain why US exponential debt growth—after

reaching certain limits—collapsed in 2008 and contributed

massively to the global financial crash.

However,

whereas the US private sector debt has marginally ‘de-leveraged’

(retrenched) since that crash (which might now be reversing), the US

government, as everyone knows, has run up mammoth deficits to

purportedly keep the country’s economy from imploding. Thus,

the US’s MPD is marching to another, perhaps even more

frightening tune, suggesting government financial insolvency and/or

debt default.

One

fascinating way of looking at the declining MPD of US government debt

has just been presented by Rob Arnott on May 9, 2011, in his post,

Does Unreal GDP Drive Our Policy

Choices? What Mr. Arnott does is to subtract

out the change in debt growth from GDP, and refers to this statistic

as ‘Structural GDP.’ He finds that, “the

real per capita Structural GDP, after subtracting the growth in

public debt, remains 10 per cent below the 2007 peak, and is down 5

per cent in the past decade. Net of deficit spending, our

prosperity is nearly unchanged from 1998, 13 years ago.”

In

its effort to counter the significant economic difficulties since

2008, the US government has added, or will have added, around $4

trillion in deficits (financed by new debt) in its three fiscal years

2009, 2010 and 2011. Yet, all this massive government deficit

spending has failed to really ignite economic growth. Most likely

this is because of the enormous dead weight of unproductive and

onerous private sector debt, particularly that of consumer debt.

Hence, real US GDP will have increased probably less than $1.5trn

during these years. Including some further economic benefit in the

years thereafter, a total GDP benefit of only about $2trn is

probable.

So,

$4trn borrowed for $2trn in GDP gains. Thus, in

very rough round numbers, each new one dollar of US government debt

might only produce $0.50 in new economic activity and probably only

about $0.08 in new federal tax revenue. (Federal

tax revenue as a percentage of GDP is around 15 per cent.) Therefore,

the economic marginal return for each new dollar of US government

debt is possibly around -50 per cent! If you loaned someone $10

million and they gave you back $5m, you would not be happy!

Hence,

it might not be long before those holding or buying US government

bonds perceive the reality that the US government, and US economy,

are losing massively on government borrowings. This will result in

much, much higher US government bond yields and

interest costs. Most importantly, it may make the rollover of US debt

and new debt issuance incredibly difficult unless either US taxes

rise stratospherically to cover the deficits, and/or the US Federal

Reserve money printing goes into hyper-drive to purchase the debt the

markets will not buy. (Of course US banks, pension funds etc., could

also be forced to buy them.)

Thus,

the idea that US government debt continues to

be ‘risk-free’ is absurd.

For

this, and for many other reasons cited above, is why the US financial

and political elites want to keep hush-hush about what the MPD and

its variants reveal!

E-mail

the writer: r.robins@alrroya.com